california nanny tax rules

Nanny tax calculator california. California minimum wage rate is 1400 per hour.

![]()

California Nanny Tax Rules Poppins Payroll

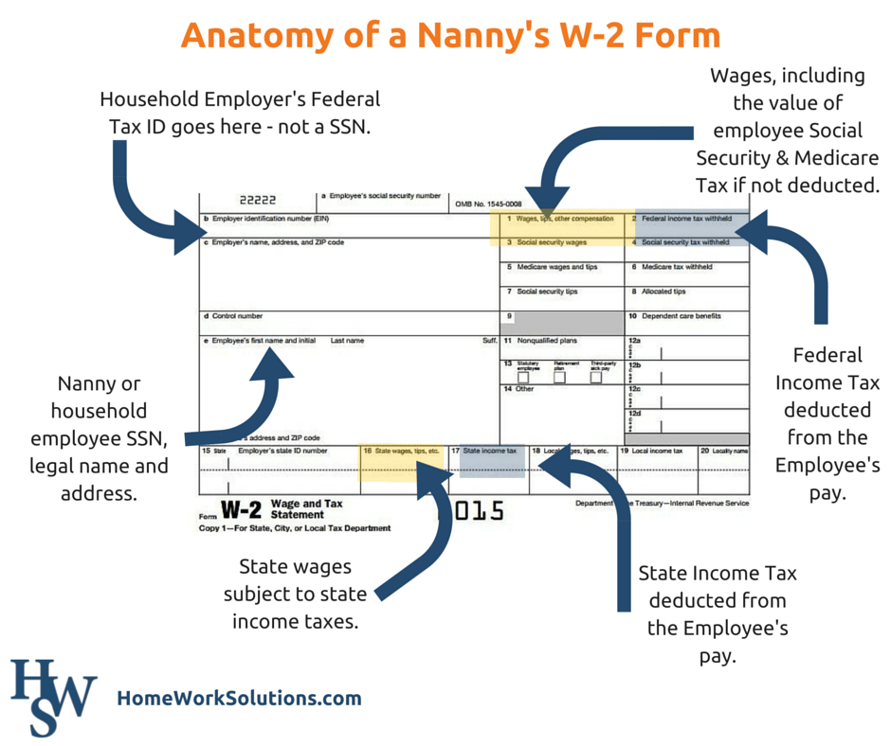

Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny.

. Household employees must be paid at least the highest of federal state or applicable local. Many California cities have local. To claim the credit the qualifying child must be under age 13 and.

Unemployment Insurance UI The 2022 taxable wage limit is 7000 per employee. A household employee is someone who does work in or around your home. Additionally hours over 12 in a.

Get a free no-obligation. Nanny tax calculator california this rate will increase by 100 per hour each year until it reaches 15 per hour in 2023. Sun jul 14th 2019 0853 am.

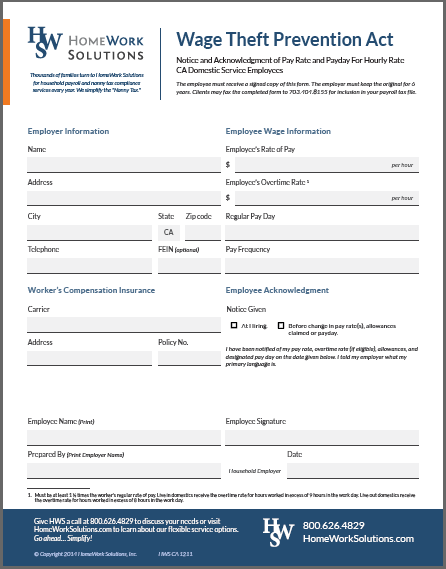

This fact sheet contains information you need to know to comply with state and federal labor and employment tax laws - the so-called California nanny taxes. A separate Form W-2 Wage and Tax Statement must be filed for each household employee to whom you pay Social Security and Medicare wages or wages from which you withhold federal. Come and go live-out general household workers.

2022 Payroll Tax Rates Taxable Wage Limits and Maximum Benefit Amounts. Nanny Household Tax and Payroll Service. Nanny Tax serves as the pathway through which domestic workers access unemployment insurance Social Se - curity Medicare and other employment-related benefits.

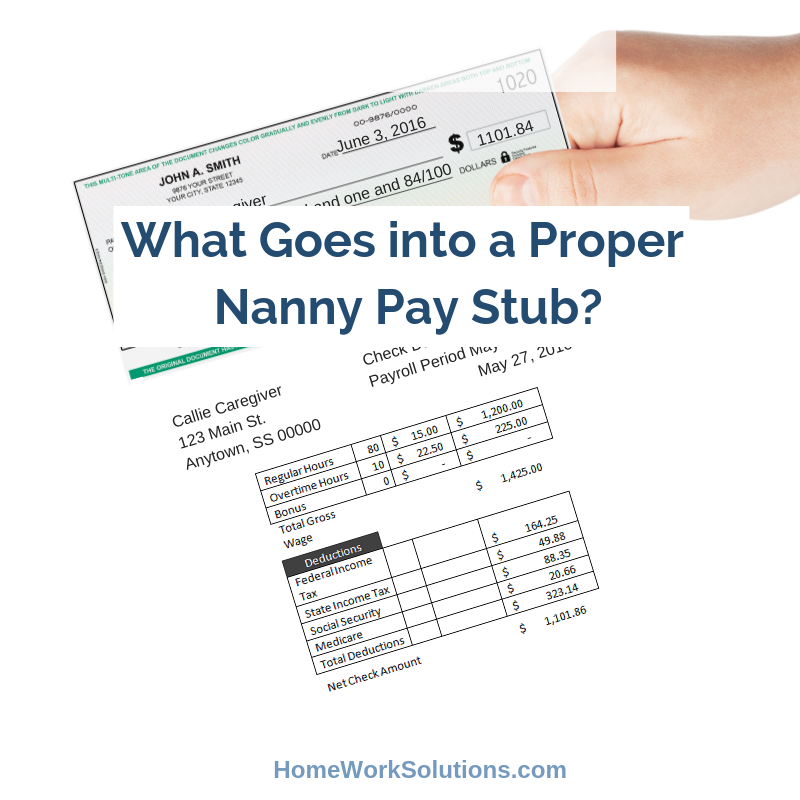

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social. California Nanny Tax Rules The fica tax is a total of 153 124 for social security and an additional 29 for medicare. Overtime at 15 times the hourly pay rate is due for hours over 8 in a day or over 40 in a 7 day work week.

Our nanny tax calculator will help you to calculate nanny pay and determine your tax. Tax labor and payroll laws vary by state for families hiring nannies and senior caregivers. Learn all the 2022 household employment rules you need to follow.

Like other employers parents must pay certain taxes. Child and Dependent Care Tax Credit. Taxes Paid Filed - 100 Guarantee.

Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. The UI maximum weekly. You are not required to register report employee wages or withholdpay any California payroll taxes because the cash wage limit of 750 in a quarter has not been met the.

Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny. Families even the most well. Nannies should be paid at least 15 times their regular hourly rate time-and-a-half for all hours worked over 40 in a workweek.

Families even the most well. In the United States the combination of payroll taxes withheld from a household employee and the employment taxes paid by their employer are commonly referred to as the nanny tax. Nest Payroll takes care of the nanny tax here is the checklist you need when you hire a nanny caregiver housekeeper gardener or anyone that works in your home.

You cant claim a nanny on your taxes but you may be eligible for the child and dependent care tax credit. A household worker is your. Sun jul 14th 2019 0853 am.

Nanny Household Tax and Payroll Service. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. Examples of household employees include babysitters nannies health aides.

Hiring a domestic employee in California or have questions about complying with the states tax wage and labor laws. When filing your 2021 taxes you can claim up to 8000 of qualifying child care expenses such as your nannys pay for one child or. Instead of withholding the nannys share from the wages parents may.

Taxes Paid Filed - 100 Guarantee. This rate will increase by 100 per hour each year until it reaches 15 per hour in 2023. Stay legal when you.

Until 1994 if you paid a nanny babysitter a gardener or any other household employee more than 50 in any calendar quarter you were obligated to. Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof. Copy A along with Form W-3 goes to the Social Security Administration.

Nanny Taxes in California California Minimum Wage. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get a free no-obligation consultation with a household.

Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof. California daily overtime law requires nannies to be. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Copy A along with Form W-3 goes to the Social Security Administration. For an employer with.

What Goes Into A Proper Nanny Pay Stub

California Nanny Employers Wage Notice Reminder

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

It Happens You Lost Your Job And Your Financial Situation Just Changed Dramatically First Start With Having An Open And Honest Co Nanny Tax Nanny Losing You

California Nanny Tax Rules Poppins Payroll

Pin On Nanny Taxes Payroll Tips From Surepayroll

California Nanny Tax Rules Poppins Payroll

Nanny Payroll Part 3 Unemployment Taxes

The Temporary Nanny And Her Taxes

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

How Does A Nanny File Taxes As An Independent Contractor

A Nanny Asks Questions About Form W 2

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

Is It Ok To Pay My Nanny In Cash

California Durable Power Of Attorney Form Power Of Attorney Form Power Of Attorney Being A Landlord

Mother Showing Media Content Nanny Tax Nanny Services Nanny